Introduction

Whilst the demise of the UK high-street is greatly overexaggerated by the British media, it’s undoubtedly stagnating as online retail continues to grow (ONS, 2018)(ONS, 2020), with 2020 seeing exponential acceleration. This report does not seek to explain why this is the case, as the reasons are well and frequently documented – although it can be largely boiled down to price and convenience. But how has skincare, a traditionally face-to-face industry, adapted to this shift from instore to online retail over the last 15 to 20 years? In short: slowly and begrudgingly.

Stores and concessions have been so deeply entrenched into the fabric of beauty retail. Home shopping television networks, at-home MLMs (Avon, The Body Shop, Temple Spa, Virgin Vie et al.) and catalogue order services were, and still are, considered examples of the industry’s ‘alternative’ subculture. In the beginning, online sat in the latter category and brands have been begrudgingly resistant to it from day one. Subsequently, while the growth of online has moved quicker than anyone could have imagined, it still seems the UK’s billion-pound facial skincare (Statista, 2019) industry doesn’t always ‘get it’.

That is not to say the world of online has not been embraced at all – far from it. But whilst influencers, bloggers and YouTubers are now the darlings of the beauty world, it took a number of years for the industry to adapt to the power of social clicks, likes, retweets and followers, with brands struggling. Arguably, between 2009 and 2012 when much of this started and gained societal traction, brands were still grouping bloggers and influencers in with the journalists, and unable to monitor the performance and value of this new media.

To illustrate some progress, for a brand like Clinique, what was once a metal, paper and acrylic ‘computer’, eventually became an real-life silicon powered computer in 2012 (Beaut.ie, 2012).

Estee Lauder Companies were one of the first brands to integrate on-counter computer systems to track customer data, despite harnessing the power of Windows CE which was ultimately retired by Microsoft in 2013.

Now on iPad hardware, this On-Counter Technology (OCT) (Estée Lauder Companies, n.d.) is used by consultants to track sales information and customer data that can be shared with online channels – trying, rather successfully, to bridge online and offline. This was launched partially in response to the EPOS sales systems within their department store locations (Debenhams, House of Fraser, Selfridges etc.) which were often still operating on the same mid 80’s software and paying no mind as to how all this data could come together, beyond restocking and the occasional postal voucher. Whilst the truism “if it ain’t broke, don’t fix it” might be applicable, MS-DOS in 2012 is now how you drive marketing and big-data innovation.

The internet has, in many cases, become the great equaliser; obliterating traditional retail hierarchy. A brand on Bond Street and a market shop at the back of Huddersfield Bus Station can feature on the same page of Google Search – if the website, service and products are sufficiently relevant. However, online has a lot to learn from the almost defunct battles of once great department stores, always trying to undercut the competition and innovate their value propositions.

But what separates the online players when it comes to offering us our cult beauty favourites that keep us looking fantastic, and feeling unique? This report looks at the key challenges in porting an offline brand – online; how the big challenges can be solved and finally some good, bad and ugly examples of their implementations.

Key Challenges

The best skincare service inevitably requires the touching of customers’ skin. This process involves feeling for oil levels, dehydration, texture and congestion whilst discussing and listening to the nuances of the customer’s skin concerns and skin history.

Other tactics might involve bringing customers to the shop door to see their skin in daylight, or the use of daylight mirrors and magnifiers.

Service like this has historically rendered consultants the gatekeepers of the shiny coloured bottles, wrapped in plastic containing their silky textured creams, akin to a pharmacist. However, as Pharmacists, Doctors and Teachers all venture into online consultations and classes, are we able to overcome the lack of physical contact? The events of 2020 have indicated that this is possible and, in some cases, more successful and efficient.

Solutions

Video Consultations

Utilising WhatsApp, Facebook Messenger Video Calling or other online video communication services to offer consultations to customers online.

Broadcast Skin Consultations

Using in-store talent, where possible, record and broadcast skincare consultations via social channels with willing customers, sharing their stories and showing how your brand tackles their concern. Ensure your comments section is well monitored as everyone is an expert. Record and share these broadcasts on your site with good categorisation and have multiple recordings per skincare concern – these may be a jumping off point for customers looking to understand their own concerns and related treatments.

AI Skin Analysis Platforms

Integrate AI platforms into your apps from companies such as Lululab, as featured as CES 2018 (Tarantola, 2018) or Revive who recently partnered with Samsung and Ulta Beauty (Parkkinen, 2019). These platforms use the customer’s phone camera to take readings of the skin. However, they can be greatly inhibited by low-quality, front-facing cameras so consider your demographic and online device profile.

Skin Testing Strips

Skin testing strips are a great way for users to check the oil levels of their skin to give them a more guided idea of their skin type. Skin testing strips by USP Solutions and similar have been used by L’Oréal and its previous sub-brand, The Body Shop, in previous years. USP Solutions now offer a smartphone app that can read the results of these strips (USP Solutions, 2020). The strips are saleable and easy to fit through the post, providing results that are reasonably easy to interpret by a non-skincare savvy customer.

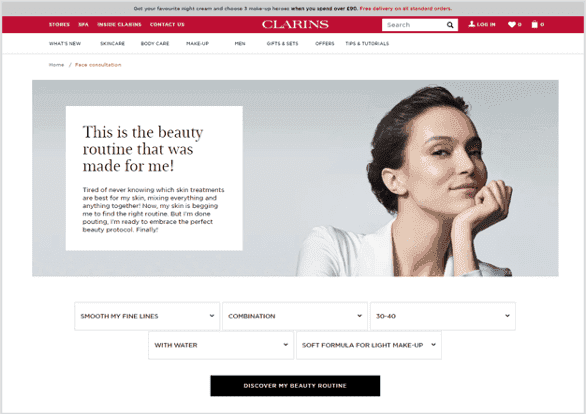

Well Mapped Skincare Tree Diagnostic Tools

Consider an online skincare diagnostic tree. These should be well thought out and consider how a customer may have multiple skincare goals, such as reducing wrinkles and reducing pore-size. Whilst these take a long time to map out, the more accurate and comprehensive they are, the more invaluable they will be to your conversion funnel.

Needs-Based Multi-Concern Faceted Product Filtration/Navigation

Faceted/filtered navigation on category pages are often a go-to for customers to whittle down their product selection on any website; skincare should not be the exception. Think about all the facets of your skincare products and allow users to filter by them. Consider texture, consistency, fragrance, concern addressed, key ingredients, free-from properties such as alcohol, preservatives etc.

As you step into the glowing shelved library of beauty in your nearest Space.NK or Sephora, a plethora of niche beauty goodies are within reach. Your basket is filled up with exciting new trends and beauty brand bestsellers. At the till you look away from the total; insert your credit card and leave, ready to go home and play with your latest purchases. Would you spend as much if you only had access to the Hourglass product library, or just Sunday Riley? Possibly not. A whole online store where a user purchases only one of your products can be a problem; and is why stores like Feel Unique and Look Fantastic et al. are so popular.

How are individual brands, particularly those in the niche sector, able to thrive online unless they are at the mercy of the online department stores, who are often known not to be the kindest bunch to their suppliers? If you use a different brand for every step of your five (thousand) step skincare regime, does your customer really want to have to place five different orders; wait for five different couriers and, when things inevitably go wrong, deal with five different returns processes?

Considering the wider needs of your customer is commonly overlooked by niche brands, as you inevitably focus on your own skincare solutions. But for the customer, your brand is one stop on a multi-step, online shopping trip and it is paramount to make this process as painless as possible.

Solutions

Guest Checkout

Although we believe our brand is the centre of our customers’ lives, sometimes a customer just wants to buy their favourite moisturiser and not embark on a lifelong relationship, so provide the option to checkout as a guest. If they return using the same email address in the future, prompt them to create a user-account with their previously entered details pre-populated.

Site Speed and Competitor Benchmarking

Use batch-testing tools to examine the site speed of every page of your website, group the scores by template type (product, category, content page etc), and then benchmark this against your competitors and see where they have the edge. Work with your web developers to trim the fat; for example, if Trustpilot integration only shows on the homepage, do not have the code for the widget loading on every other page in the site. Getting the speed advantage over your resellers might give you the edge, and as your site is likely to be slimmer, it is also a real possibility.

Behavioural Dialog Boxes (Leaving, Browsing etc)

There is code that can be added to your site that can detect if a user’s mouse is going towards to the top of the page and about to click the x-button, maybe to browse for the same product on another site. This can be used to display an immediate offer or discount to tempt the user to stay and buy direct.

Highlight Bestsellers

If your brand is known for a specific product or set of products, then do not hide these in the mix of the rest of your skincare wardrobe. You may think this is subtle cross-selling technique but it is likely to aggravate the user. Make sure your best sellers are at the best price where possible and price match these against your competitor(s). Consider cross and up-selling later on in the journey with complimentary products to match those best-selling heroes.

Expert Concern and Results Content

If you have a product, or range of products, that tackles a specific skin concern, create content that explains how your brand views this concern and your approach to treating it. For example, does your brand differentiate between dryness and dehydration? (Tip: it should). Use these pages as an opportunity to demonstrate the expertise and authority of your brand by highlighting the knowledge of your founders, skincare experts, formulators, or consultants. Anything even vaguely medical should be referenced by relevant academic and medical sources as this content is analysed by Google to prevent the spread of misinformation. Use good photos to illustrate concerns that customers can relate to, keeping them as well-lit and as tasteful as possible – it is a skincare article, not a murder scene.

Off-Season Promotions

New Year, Easter, Mother’s Day, Father’s Day (for your grooming lines), Black Friday, Christmas and Boxing Day: brands and stores have most of these events covered. Consider off-seasonal promotions to ‘surprise’ new and existing users to avoid products appearing as ‘sale’ and risk cheapening your line.

In store, customers can get their money back instantly if paid in cash, or quickly if paid with card. Products can often be swapped instantly if they are broken or packaging fails. Depending on your brand policy, you will already offer instant refunds if a customer has a perceived allergic reaction and again, in-store, they receive an instant refund.

However, when you have already waited three days to get your product and it arrives damaged or is not what you expected, what do you do? You have to package it up, take it to a Post Office or courier collection point, and wait for a refund. Research indicates many users may throw an item away rather than returning it if the value is low enough, but this may be enough to damage perceptions of your brand and not encourage repeat custom.

Solutions

Easy to Find and Well Laid Out Returns Policy

Make sure customers know where they stand if they do not get along with your product. If they open it and dislike it, can they do anything about it, or does it have to be re-gifted or thrown away? What happens if they have a reaction? Assure customers by providing a clear and simple returns policy, highlighting that the process to return items is not going to be subject to argument and arbitration – if it is, consider simplifying it. Frequently asked questions may also help:

- What if I have a reaction?

- What if I do not like the product?

- What if the product arrives broken?

An admission of these things is not a sign that your brand or products are bad but an acknowledgement that these things happen. Be pragmatic.

Pickup services

Using Hermes and DPD pickup services can make things much easier for customers to send items back. These services are not cheap for a business and could be considered for brands with higher value items. Depending on your returns policy, this is a service that could be utilised for unopened gifts and coffrets, if those are a significant part of your brand.

Returnable Packaging

If an item or items can be returned in the packaging it was delivered in, this makes the process of returns less stressful for the customer. Having to find suitable packaging and tape may be aggravating, which could result in the user disposing of the purchase and moving onto other brands. Delivering products in resealable packaging makes the process easier.

Print-Free Returns Services

Household printers are much less common now than they were 10 years ago. For customers who do not own a printer, drop-off services from brands such as Hermes or DPD can be done without printing, which again removes another barrier to returns. Also consider including a returns label along with a small form to report the issues and reason(s) for returning.

Agentless Returns

Depending on your returns policy, users should be able to return skincare products purchased online just as they would with a clothes order – particularly if the product is sealed. Having to talk to a customer service representative on the phone or wait for someone to respond on email may be considered aggravating at the best of times, especially when different members of your customer service team may interpret customer issues differently. This is magnified when the product is of reasonably low value. Whilst agentless returns are open to abuse, consider how this may be offset with a reduction in your websites perceived risk by potential customers.

Free Returns Postage

Do not charge users to return items if you do not have to – they’re already out of pocket for the unwanted goods and they don’t want to have to pay out further. Some websites may offer to refund the postage if they scan and email the receipt, but this makes the experience seem difficult and may inhibit return visits. Free postage only to a store if that’s part of your business can also be frustrating, as the customer may have had reasons for shopping online and not instore in the first place.

In-store, customers can take away and use your product then and there. They do not have to wait to take their purchases home and use them, and benefit from instant gratification. This is why customers tend to spend more instore versus online, and particularly spend more on impulse purchases (Petro, 2019). Consumers are also more likely to shop instore to feed that hedonistic monster, whereas online retail can still be considered largely utilitarian (Cai et al., 2012). This can be a big blocker for skincare, particularly when you are trying to sell at the upper ends of the price spectrum.

When shopping in-store, that beautifully tactile, metal, under-eye applicator catches the customer’s attention. At only £15, this will gorgeously compliment their eye cream and your customer eagerly anticipates using their new purchases as soon as they get home. When browsing online for a skincare item that is bought as a treat, extravagance or luxury, the excitement of this experience can be tarnished by slow delivery.

This is particularly true once a customer must wait 3-5 working days; be at home for it or receive the inevitable ‘Sorry you weren’t in’ slip. As such, getting your delivery quick, free, and right makes a huge step in recreating that impulsive naughtiness we feel in store.

Choosing a good delivery courier is hugely important and while some couriers give you great business pricing, your customers may hate them with a passion – not naming any names. The following are Trustpilot scores (correct June 2020) for the most used courier delivery services. Consider how these companies represent your brand and business as they take responsibility for the final, and arguably most important, leg of your customer journey:

- DPD: 4.7/5

- Hermes: 4.2/5

- Royal Mail Parcel Force: 2.2/5

- Yodel: 4.4/5

- DHL: 2.9/5

- UPS: 1.7/5

Solutions

Courier Choice

Where applicable, give users a choice in courier. For example, 3-5 working days Royal Mail; Next Working Day DPD and/or Saturday Delivery Yodel. Customers have good and bad experience with respective couriers, and it is important that your choice of courier does not block their decision to purchase. Do not make this unmanageable with an endless list of options; ensure you are choosing a particular courier for its strength such as speed, consider overall reliability and select low-cost options for slower delivery.

Delivery Subscription Service

Next-day delivery subscriptions, such as those offered by Amazon, Feel Unique and ASOS, can help increase return customer rate. Shoppers know their postage has already been taken care of and this gives customers another reason to shop with you rather than buy the same item, at the same price, from your competitor.

Competitor Postage Pricing

Regularly review the postage pricing of competitors and consider adjusting accordingly. Being in line with competitors or undercutting them will reduce the barrier to conversion.

Courier Losses

If an item is lost in transit, issue an immediate replacement before the courier concludes their investigation where possible. This is understandably dependent on the value of the product, but where items have a low cost, this may be an option.

The once mythical unicorn that is the men’s grooming market has increased significantly over the last 10 years, but probably not by as much as projected. The men’s grooming market became oversaturated with Victorian Barbershop themed beard oils, gels and waxes and has not diversified as hoped. As such, we are still a long way off the average man calling out for “Hyaluronic Acid, Pentapeptides and PA+++ sunscreens!”. Although we do tend to use a lot more deodorant now… which is nice for everyone.

This market is still largely uneducated, with men having a more limited exposure to the beauty market. This means the minefield of online retail stores continues to be a barrier to entry, with men struggling to differentiate between the 90,000 different moisturisers that all purport to do the same thing, while all claiming to be better than their competitors.

However, educational and product condescension with outdated formulas, crude descriptions and photos of lumberjacks, all wrapped up in a black squeezy bottle, might not be the way forward. This is particularly clear online, where the same messaging, imagery and packaging all blends into one.

Solutions

Draw on Inspiration from Men’s Brands

Consider drawing website inspiration and layout from male driven sectors such as tools, hardware and technology. Look at how solution focused they are, even when describing the products. Eliminate superfluous language and wow-factor lifestyle photography.

Descriptive Funnelled User Interfaces

Although male users are often not as skincare savvy, do not patronise them. Use good descriptions around skincare terms and ensure that too much choice isn’t given; men are less likely to purchase if several products with similar properties are offered in groups, as opposed to targeted, solution-based products that are served through funnelled guides from a-b.

Plain English and Well Laid Out Feature Sections

Use plain English and try not to over-medicalise language around product properties or skin concerns. This should not be exclusive to men, but men are more likely to find pseudo-science a blocker as they are not as used to this staple of the skincare marketing world.

When trained and hired well, consultants are the lifeblood of your skincare brand. But what happens when your entire customer experience cuts them out? Consultants do not just provide skincare advice but help with link selling, retention and loyalty schemes, gift buying, and create a warm, relatable public face for your brand.

Interestingly however, a 2011 study showed customer satisfaction levels and loyalty are not actually compromised by online versus face-to-face relationships (Byrnes and Mujtaba, 2011). The study indicated that non-direct contact methods such as email and online proved more successful.

It therefore could be argued that some customers are more comfortable and feel less pressured when not interacting directly with a consultant – but let us not write them off too quickly!

Solutions

Video Consultations and Live Chat

Use WhatsApp, Facebook Messenger Video Calling or other online video communication services to offer consultations to customers online. Live chat functionality, as a minimum, may allow customers to get difficult questions answered.

Well Mapped Skincare Tree Diagnostic Tools

Consider an online skincare diagnostic tree. These should be well thought out and consider how a customer may have multiple skincare goals, such as reducing wrinkles and reducing pore-size. Whilst these take a long time to map out, the more accurate and comprehensive they are, the more invaluable they will be to your conversion funnel.

Needs-Based Multi-Concern Faceted Product Filtration/Navigation

Faceted/filtered navigation on category pages are often a go-to for customers to whittle down their product selection on any website; skincare should not be the exception. Think about all the facets of your skincare products and allow users to filter by them. Consider texture, consistency, fragrance, concern addressed, key ingredients, free-from properties such as alcohol, preservatives etc.

Phone Consultations

Having a customer service line where customers can speak to someone over the phone to try and explain the nuance of the skin concerns could be valuable. Knowing there is someone who can explain the products in the comfort of their own home without the need to ‘dress up’ will undoubtedly generate brand buy-in.

Every customer likes to think they are a sensitive skincare customer. And to an extent, they are right, as unless your skin is made of asbestos, everyone’s skin can be sensitive. However, it is crucial to establish whether this is genuine hypersensitivity or a handful of noticed reactions over their lifetime. Sensitive skin is significantly over-reported (Bernstein, 2009). Acne, rosacea and eczema are also often seen misdiagnosed (Celletti, 2017).

When a customer is always running to the sensitive skincare section on your website without guidance or knowledge, they may be missing out on products more suited to them that they might not otherwise have considered. However, what happens when you open your entire product wardrobe with powerful active ingredients, without the buffering of a consultant, to customers who might not know their skin as well as they think they do? This can be a make or break first experience of your brand or the perceived credibility of your website.

A study into self-diagnosis of Acne found that 100% of participants could identify their acne concerns when provided with labelling and clear descriptions of different categories of acne (Gold et al., 2009). Consider how this identifying information can be incorporated into your website.

Solutions

Expert Concern and Results Content

If you have a product, or range of products, that tackles a specific skin concern, create content that explains how your brand views this concern and your approach to treating it. For example, does your brand differentiate between dryness and dehydration? (Tip: it should).

Use these pages as an opportunity to create expert and authoritative content by your brand’s founders, skincare experts, formulators, or consultants. Anything even vaguely medical should be referenced by relevant academic and medical sources as this content is analysed by Google to prevent the spread of misinformation. Use good photos to illustrate concerns that customers can relate to, keeping them as well-lit and as tasteful as possible –it is a skincare article, not a murder scene.

Needs-Based Multi-Concern Faceted Product Filtration/Navigation

Faceted/filtered navigation on category pages are often a go-to for customers to whittle down their product selection on any website; skincare should not be the exception. Think about all the facets of your skincare products and allow users to filter by them. Consider texture, consistency, fragrance, concern addressed, key ingredients, free-from properties such as alcohol, preservatives etc.

Video Consultations and Live Chat

Use WhatsApp, Facebook Messenger Video Calling or other online video communication services to offer consultations to customers online. Live chat functionality, as a minimum, may allow customers to get difficult questions answered.

Well Mapped Skincare Tree Diagnostic Tools

Consider an online skincare diagnostic tree. These should be well thought out and consider how a customer may have multiple skincare goals, such as reducing wrinkles and reducing pore-size. Whilst these take a long time to map out, the more accurate and comprehensive they are, the more invaluable they will be to your conversion funnel.

Phone Consultations

Having a customer service line where customers can speak to someone over the phone to try and explain the nuance of the skin concerns could be valuable. Knowing there is someone who can explain the products in the comfort of their own home without the need to ‘dress up’ will undoubtedly generate brand buy-in.

When shopping in-store and trying to determine if the product you are looking at is available at the best price, there is a number of things we tend to do. Firstly, we all pull our phones out and check online – 80% of us in fact (Market Track, 2017). But if it is cheaper online, you have to wait for it versus picking it up then and there. The majority of us tend to choose the latter option, particularly when it comes to impulse purchases (Petro, 2019).

You could also visit another store near you that is selling the same items, which is often case with skincare – especially in larger city centres. However, if there’s a multibuy offer on; the store is fresh and clean; there’s a friendly skincare consultant; or there’s a product that you’ve tested and like the feel of in that moment, these factors will all have a significant impact on your purchase. After all, its’ not just about price (Wu et al., 2011). Online however, the story is much different.

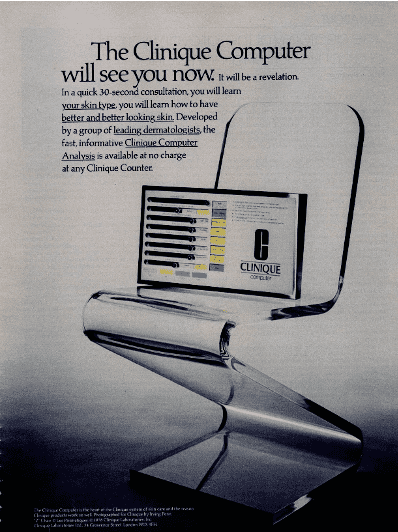

When a customer has decided to purchase a product online instead of going instore, they have likely already considered delivery implications and timescales. How long they must wait to get their products and how much that service costs, is down to you as the retailer. But within only a few clicks, you have the following major stores, all selling pretty much the same products:

To put this into some more perspective, the below shows the comparison of online retailers (correct as of 19th June 2020) in order of total price, selling the same Clinique Dramatically Different Moisturizing Lotion+ 125ml Pump Bottle (DDML+)

By looking at the above, if it were only about the best price, All Beauty would be selling every single bottle of DDML+ with Boots selling absolutely none. As this clearly will not be the case, consider the value each of those brands are giving outside of pricing.

Solutions

Reference Pricing

Use reference pricing showing ‘Was’ and ‘Now’ pricing (Grewal et al., 2010) to convey urgency and limitation of the deal. Even consider experimenting with colours through user testing and see which colours your users respond to (Grewal et al., 2010) – this may not be the same for every brand, niche and website.

Key Proposition Labelling

Label and link your offerings or promotions such as Free Delivery, Student Discount, Next Day Delivery, etc. and track interaction against these. This will help you establish why customers are choosing you and may be particularly useful if you sell similar or the same products as your competitors.

If your brand is selling products from a third-party/online department store, as well as through your own site, how do they ensure website customer retention? In-store you are able to do it through loyalty cards, favourite customer consultants, and in-store events. Is it only about price online? What is it about your website keeps a customer going to you instead of the competition?

Offline brands that move online have a big advantage: recognition. Offline brand recognition reduces your customers’ perceived risk when shopping with you online (Kwon and Lennon, 2009). In turn, this also helps reduce the cognitive dissonance when selecting you from a myriad of other online retailers. After all, we’ve all visited online stores that have what we want at the right price, but something in our brain tells us it’s a risk and we should shop somewhere more ‘reputable’ (Kwon and Lennon, 2009).

Solutions

Third-Party Review Services

We may not like to be at the mercy of these services, but third-party review sites are here to stay. Be upfront with your Trustpilot or other online review service store – if your score is not good, work night and day to fix it and don’t ignore criticism of your service – and use word cloud analysis to identify common themes in customers feedback.

Customer Surveys

Gather customer feedback using surveys and services such as Hotjar to find out why customers come back. On the other hand, outreach to single purchase users and ask them why they did not return – negative feedback can be exceptionally useful and allow for the correction of small issues that may make a significant difference.

Brand Loyalty Schemes Online and Offline

If applicable to your brand, crossover instore loyalty schemes online and offline. Work to combine your brand loyalty schemes and stop differentiating between the two.

Delivery Subscription Service

Next-day delivery subscriptions, such as those offered by Amazon, Feel Unique and ASOS, can help increase return customer rate. Shoppers know their postage has already been taken care of and this gives customers another reason to shop with you rather than buy the same item, at the same price, from your competitor.

Competitor Price Matching

Review competitor postage pricing and adjust accordingly. This can be limited to bestselling products or more competitive lines but look at matching competitor promotions or pricing. Whilst there are a number of other solutions to customer retention and loyalty, pricing will still be a key barrier to conversion.

Buying products online that you have not sampled is a risk for a customer – a big risk depending on how much you are considering spending. Skincare is one of the most harshly affected by this, exceptionally harshly. If you open it and do not like the smell or texture, what do you do? Instore you can try products on the back of your hand from a sample pot; walk around a little bit and see how it sinks in. Skincare consultants may also be trained to apply the product and give you a free mini facial to see how it sits.

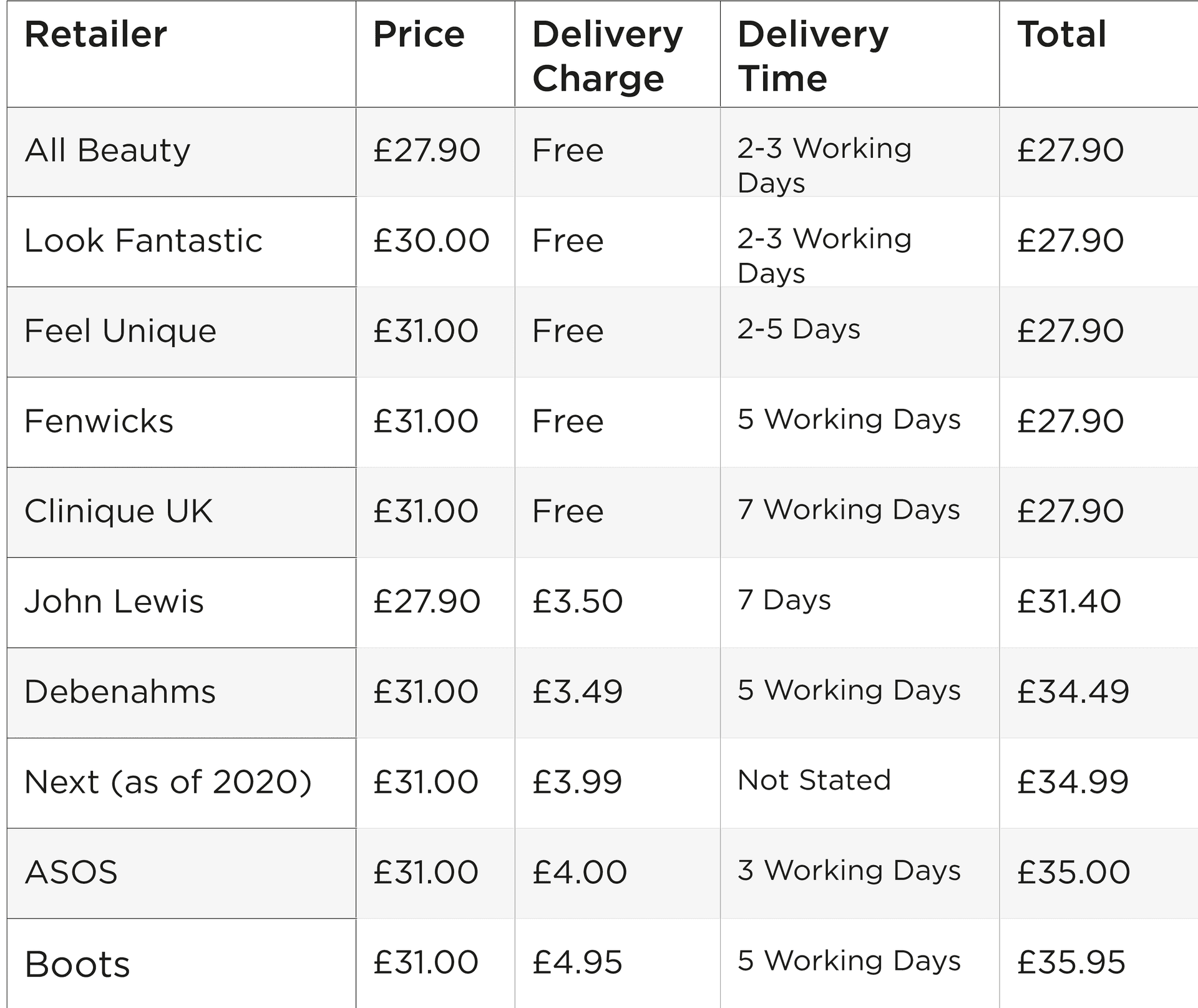

Although every brand thinks they’ve got a product suitable for everyone, we know that’s not the case, and that goes to explain why when asked, 54% of people said they use more than four different brands of skincare on a regular basis.

When it comes to online therefore, it is a risk-filled minefield for customers with wrong moves, which could potentially cost a lot of money and damage your brand.

Solutions

Swatch Photography

Carefully taken product swatch photography can give information about the product that is almost impossible to relay through text alone. Texture, mattification, sheen, water-content and weight are all communicable via photography to one degree or another.

Sampling

Samples and sampling are a core component of the offline, in-store experience, but this is often missing in online retail. Offer customers complimentary and related samples with purchases and/or allow them to choose what they select. Sample boxes containing larger or deluxe samples could be sold with a voucher for the user’s next purchase.

Well-Written Descriptions

Professionally written descriptions that are needs-based and describe every facet of a product are key in negating perceived customer risk. For example, everything about a product may point in the right direction for a customer, including swatches and user reviews. However, if a key detail such as the product fragrance were to be omitted, that could lead to a product return; and depending on your policy, once opened, they may be stuck with the product. That leaves a customer resentful and damages the perception of your brand.

Product Ingredients

Ensure there are comprehensive and visible ingredient lists on product pages. Customers are much more skincare savvy than they used to be, and many customers may seek to avoid certain ingredients. If your product contains ‘controversial’ ingredients such as alcohol or fragrance, explain why they are there – if you cannot explain them, reformulate. Hiding your ingredients may achieve an immediate sale but will not create brand loyalty in such a crowded market.

Searchable Reviews

Enable search functionality on product reviews so customers can search for keywords when deciding on their intended purchase. Knowing another customer had a similar experience to you and your product did or did not resolve it, will give more confidence in whether to buy or not. If a search does not yield results, give customers the option to ask that question to a customer service agent or live chat handler.

Live Chat Functionality

Consider implementing live chat features allowing customers to get someone on hand to answer difficult questions or provide specifics about products that might be too nuanced to have written in the product description. Live chat should aim to respond quickly. The use of learning AI bots, over time, may reduce the amount of people-time required to operate the service.

Beauty stores and halls were traditionally a place where women could go either with friends and family or on their own, where there was a sense of community and interaction with other customers and consultants who were all there for a shared reason – the love of beauty.

Humans are social creatures and skincare is a very social thing; a tool for wellbeing and self-empowerment, it can give us confidence on so many levels. However, when a brand moves online, that fabulous hustle and bustle of the instore experience and the ‘escape’ is lost. Not only this, but the longer time a customer has to consider their purchases, clarity of thought may get in the way of those impulse purchases.

Solutions

Searchable Reviews

Enable search functionality on product reviews so customers can search them for keywords that may help them decide on the purchase. Knowing another customer had a similar experience to you and your product did or did not resolve it, will give more confidence in whether to buy or not. If a search does not yield results, give customers the option to ask that question to a customer service agent or live chat handler.

Live Chat Functionality

Consider implementing live chat features to allow customers to get someone on hand to answer difficult questions or specifics about products that might be too nuanced to have written in the product description. Live chat should aim to respond quickly. The use of learning AI bot chat services, as they learn over time, may reduce the amount of people-time required to operate the service.

Video Consultations

Use WhatsApp, Facebook Messenger Video Calling or other online video communication services to offer consultations to customers online.

Customers Also Bought

‘Customers Also Bought’ sections and recommendations from other customers are especially useful. Even though as a brand or store you’re more likely to know your products better than anyone, it’s hard to eliminate bias in the minds of your customer, who may perceive your recommendations as being financially motivated rather than in the interests of your users.

Customers’ Social Media Posts

In online retail, highlighting customers social media posts and recommendations could be considered an ‘oldie but a goodie’ in seeking to reduce perceived brand bias. Do this subtly by making use of Instagram, as pictures are an easier way to convey information online and retain user interest. Avoid influencers, particularly if targeting men or older people (Hautala, 2019) as their motives may be perceived as financially biased outside of their fanbase – it’s like advertising on your own website instead of celebrating your customer base.

Implementations

From the solutions we have explored throughout this report, the following are examples into those that have been done successfully… and not so successfully. We have suggested ways these solutions could be improved as well as exploring brands and stores who have implemented them successfully.

When customers cannot physically touch your products, you can convey the textures and skin-feel through well-executed product photography. Using well-positioned lighting with lighting direction to convey highlights and shadow, illustrating how a cream or serum may sit which in turn conveys thickness, richness and texture. Light can also be used to highlight sheen on a product and even convey oil content.

LUSH Ltd are an exceptional example of good product swatch photography. They highlight the product first, not the packaging, which means you can browse products via look and perceived feel rather than which has the prettiest, sleekest packaging – which is good for LUSH as their products come in relatively uniform or with no packaging at all.

The Body Shop has certainly made good headway with their swatch photography but would benefit from the points outlined above. Currently their lighting and swatch style make it difficult to discern texture, weight, and thickness. Increasing both brightness and contrast, brighter studio lighting and tweaking the ISO, exposure and f-stop balance may make these samples easier to interpret.

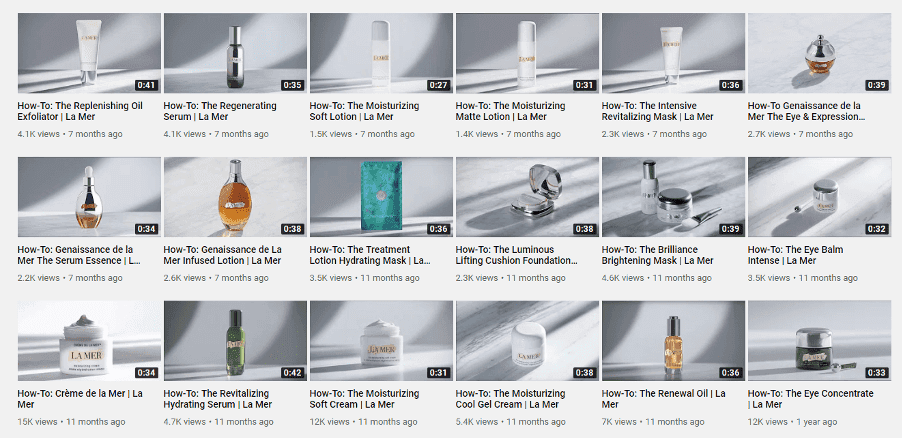

Another brand who excels in conveying the feel of their products online, including their application, are La Mer. Their YouTube channel, that they frequently embed throughout their online presence, contains ‘How To’ videos almost exclusively.

These videos are about the product and skin-feel, not the models and the lifestyle. The La Mer videos are relaxing to watch and can be consumed with or without audio, which is an important consideration depending where and when the customer is watching.

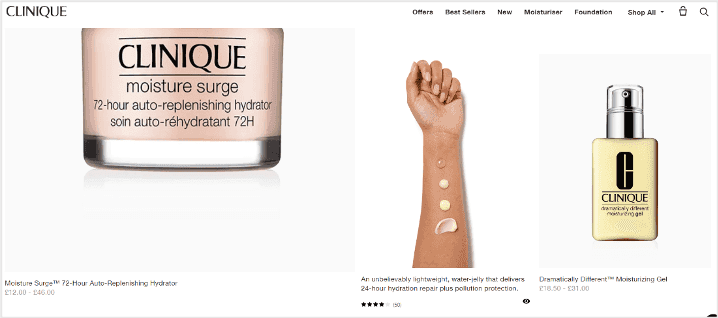

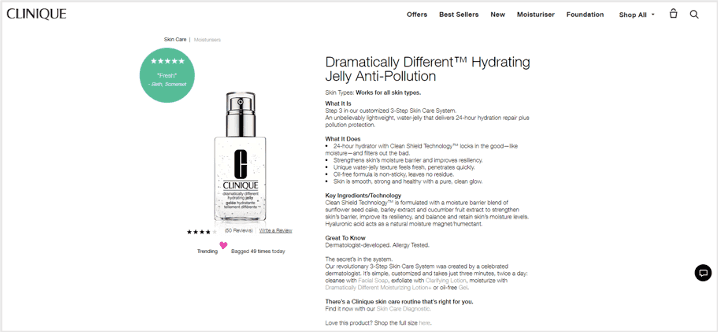

A brand who deals with product swatches very strangely is Clinique. Whilst they have some swatches with a mouse/image rollover, these are present on only a comparatively tiny number of products. Stranger still, they disappear once you move from the category to the product page. This makes for a poor user experience and is very contrary to the Clinique on-counter experience, where every product has a sample available for customers to open and play with.

Clinique’s swatches are wildly inconsistent, sometimes used as a prop, on skin models or images of ‘normal’ swatches. Keeping swatches consistent and easily accessible on every product enables texture comparisons, which allows customers to decide which products may be better suited to them, elevating buyer confidence and reducing perceived risk.

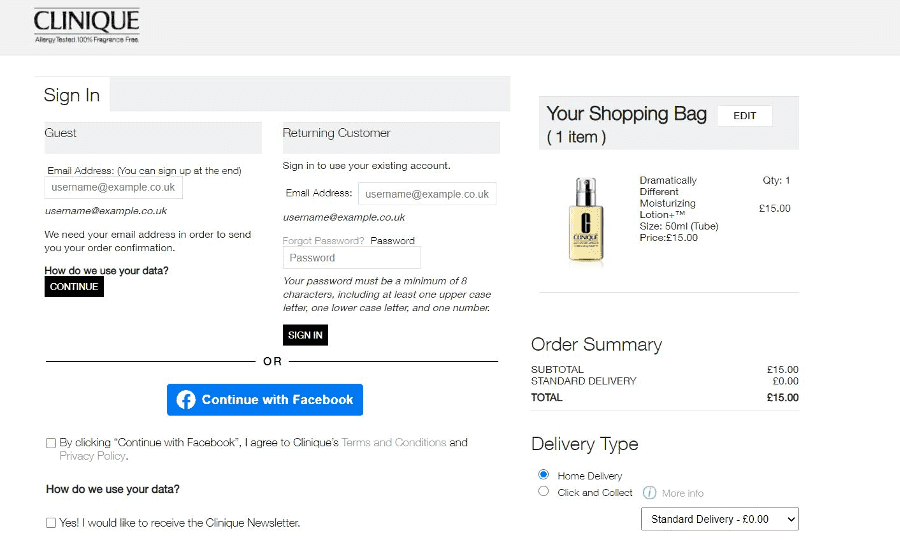

Asking potential customers to register an account before buying from your website adds another, potentially unnecessary step to the buying process. There is significant evidence that shows a slower, longer checkout process is a barrier to purchase.

Online retail cart abandonments currently sit at around 76% (Charlton, 2019). Further research (Charlton, 2019) found 34% of users abandon their baskets at checkout because they are forced to create an account. A further 26% cited a ‘long or complex process’ as the primary reason for not purchasing when at checkout.

Being faced with only two options; ‘login’ or ‘register’, creates extra work for shoppers and is not how users have to interact instore. A guest checkout should always be offered on your site. Providing the ability to quickly and seamlessly create an account later or after-purchase is a much more user-friendly approach. This prioritises revenue over data and takes into account that your customer’s single skincare purchase might be one of a number of purchases they make online that day.

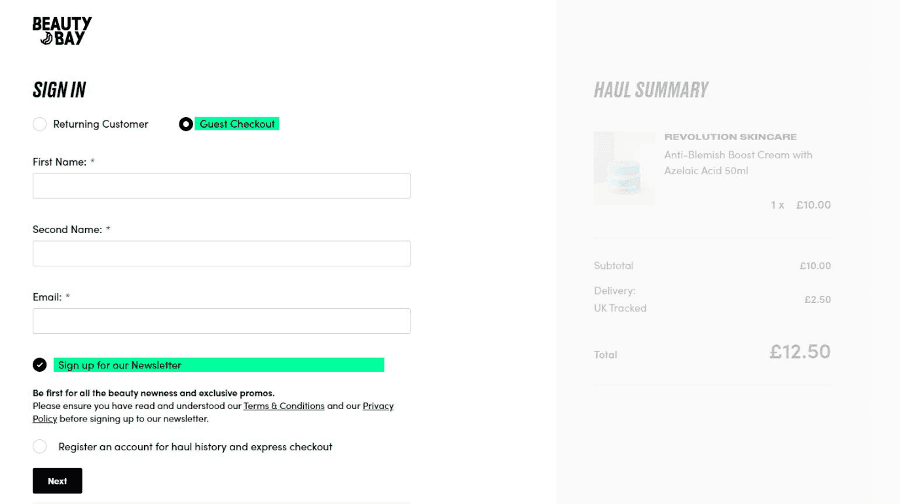

Beauty Bay offer a great example of a simple and clean use of a quick guest checkout process. They use a tick box to present a simple and short data capture form, whilst keeping the shopper’s active basket visible on the screen at all times.

Whilst Clinique UK offer a guest checkout option, the initial checkout UI is cluttered with several options, including Facebook account access, trying too hard to please everyone with everything. More could be done to simplify this screen and clearly present the two checkout options – guest versus returning customer. Again, they make use of keeping the shopper’s basket visible at all times throughout the checkout process.

There is a growing trend towards weaving powerful storytelling into sales and marketing. Today’s consumer buys into the founders of a brand, the stories about their backgrounds, why they started their business and any behind-the-scenes footage and insights from the creation of their products. Heritage is very important to a brand and can help separate those who are creating products through passion rather than wanting to make a quick buck.

There are so many outlets for sharing a story today; website blog posts, social channels, podcasts, that brands cannot be afforded the excuse of not reaching a wide audience beyond their owned channels. If you have not done this before, pick one or two of these and run with them, rather than doing unsubstantial bits on each one.

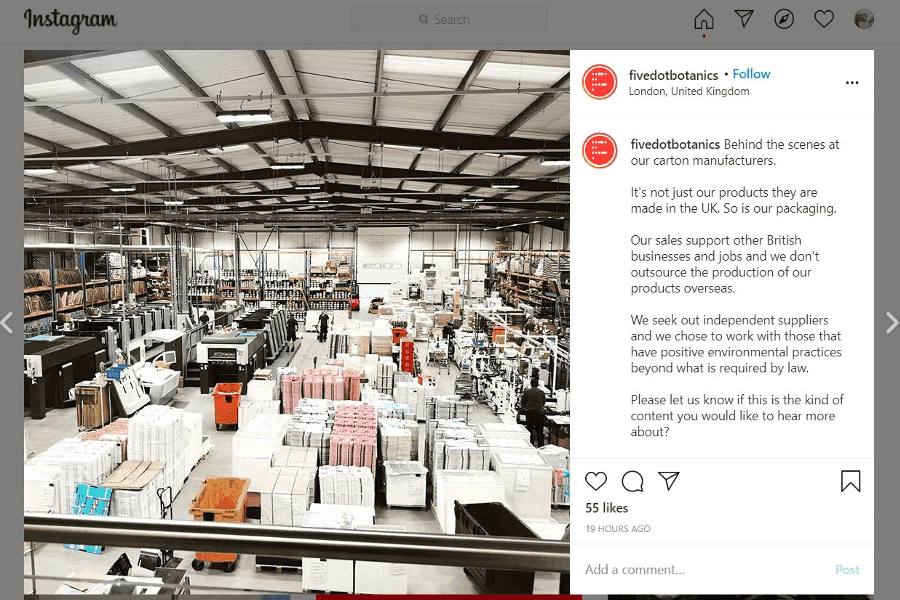

Five Dot Botanics are a great example of a brand that has found its voice and purpose through storytelling. They share history, insights and wisdom effectively across their multiple channels – social, blog posts and podcast guest appearances.

Five Dot Botanics’ highest-performing blog post is about why the founders of the company love Morse code – and the story behind the logo (Dancing with Startups: The rise of the Minimalist Brands CEO Five Dot Botanics Zaffrin O’Sullivan, 2020). Their Instagram is laden with behind the scenes photos, welcoming customers into their world, allowing you to wonder if the product you have received was sat there on the shelf at the time.

From the retailer side of skincare, Credo Beauty are a fantastic case study for storytelling. Credo have a section of their website dedicated to showcasing the founders and CEOs of the brands they stock and promote.

Their social channels feature and celebrate the stories behind the brand founders and product creators, almost entirely removed from a ‘buy it now’ product message. Credo Beauty have done a great job of building a powerful social community taking this approach, aligning themselves to the pioneers rather than the products, and enhancing their authority.

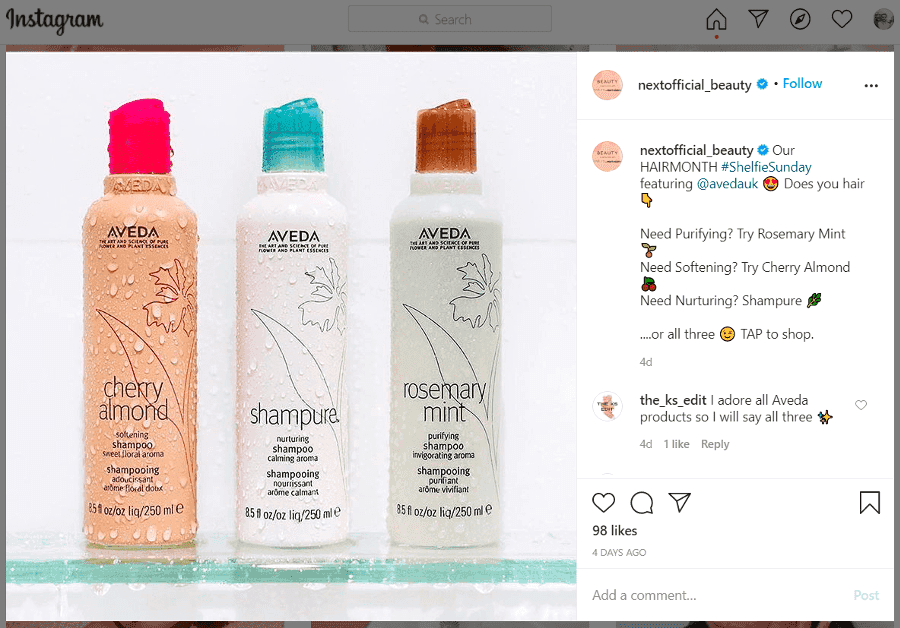

On the other side, Next Beauty’s social feeds simply talk product, product, product. Education on the products and their efficacies is key for consumers, and Next do this well via how-to videos, however consumers are not provided with stories and insights from the founders of the brands they sell – there is no differentiator. Because of this, the relationship between the brands and retailer feels transactional, rather than emotional. It does not compel users to buy from you over your competitor.

Whilst it’s harder for multi-brand retailers to tell a brand story to the same level as the brand founders themselves, retailers like Next Beauty could follow a similar path to Credo Beauty, or find a balance by introducing brand and product storytelling into their regular marketing and sales cadence. The key: showcasing the authority behind the brands you have chosen to stock.

Skincare diagnostics trees are a common and sometimes useful way to help customers find the best product for their skin type and skin concern. The problem they often present is that, if not written well, this closed loop system can easily send users down the wrong path. This can be caused by the questions or answers not being explained properly, e.g. Do you have dry skin? To the average consumer, there is no difference between dryness and dehydration.

If you recommend oil-based products to a customer with dehydrated but oil-rich skin, prepare for congestion-central. Asking questions such as “Do you see visible flakes on your skin?” or “Does your skin feel tight after cleansing but becomes comfortable by midday?” will help to pinpoint the subtleties of customer concerns in ways they’re more easily able to answer.

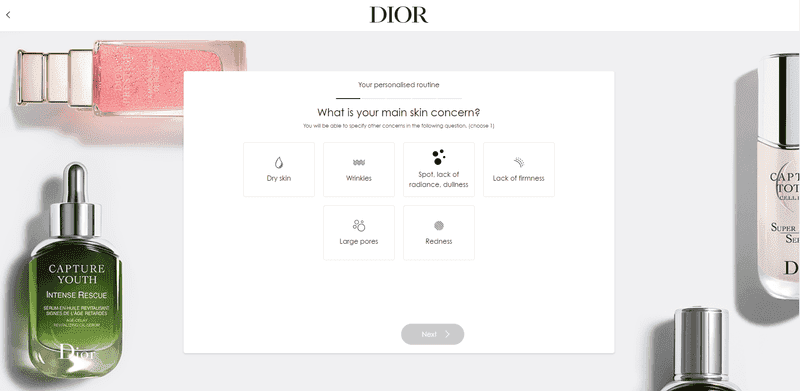

Dior’s skincare diagnostics tree is representative of the common pitfalls many brands fall into, simply because it is easier and requires less development, allowing only one answer per page. Let’s think about the menopausal female customer for a moment; statistically they have the largest disposable income (Statista, 2018) yet also some of the most difficult skincare needs with combinations of extreme oiliness and acne and then dryness, as well as sensitivity, burst blood vessels and redness to name a few.

So, when Dior, asks “What is your main skin concern?” to a customer with money to burn, but possessing a swathe of skincare issues, you have almost immediately lost them. What do you mean, “main” and then “secondary”? Reading this, you probably have an idea, but does your customer? You can be dry/oily/combination with acne, enlarged pores and wrinkles – they all interplay.

Multivariate Product Matching

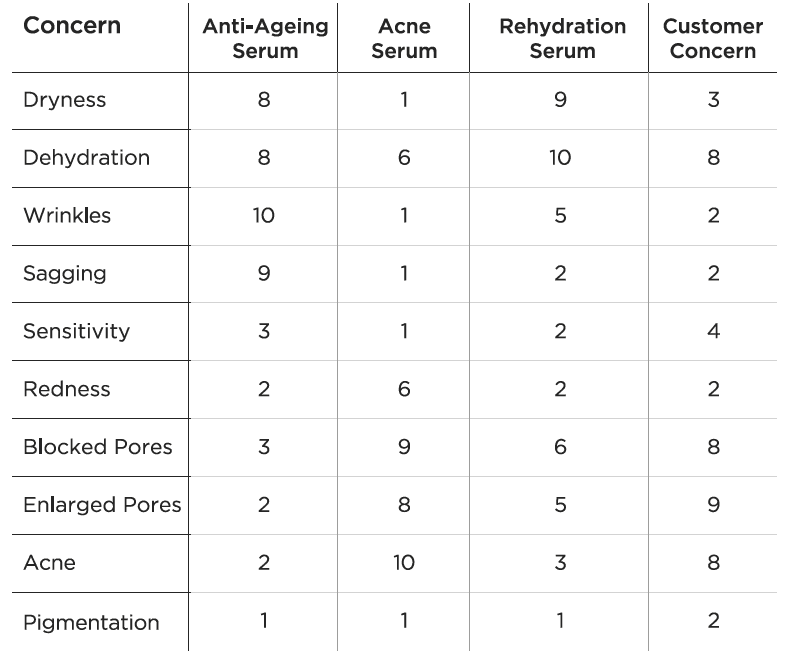

Consider implementing a system that gives results based on multivariate data, matching skincare solutions with customer concerns based on their perceived priority. The below shows an example of three fictitious serums: one for acne, one for ageing and one for dehydration. The table shows, out of 10, how much of each concern the serum is targeted towards, and then answers given by a customer from a more flexible skincare diagnostic tool:

The results below show that the most suitable serum for the customer would be the anti-acne serum. The orange dashed line represents the customer concern and it most closely, even though not identically, matches the acne serum.

Skin concerns could be established in this way to more accurately define them rather than relying on the customer to self-diagnose, as explored in the example questions above. The results of these more reliably established skin concerns could then be matched to a product through a secondary level multivariate. Any statistically significant outlying concerns that are not met by the product being matched, such as the customer’s dehydration concern in the above example, could be addressed through supplementary products. There are many ways to cut this up.

Depending on customer feedback from products purchased using this function, you could use this data, through machine learning, to confirm or alter specific variations depending on their perceived success/accuracy.

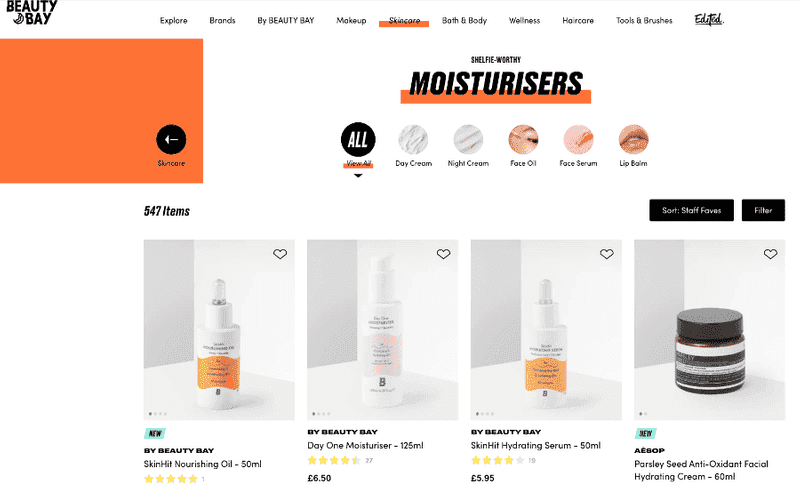

When you display your product online, in an image/grid-based category (like most ecommerce stores do) you are relying almost entirely on the image to sell the product. If you have a 20-strong moisturiser wardrobe, and present that in ‘Moisturisers’, unless the customer knows what they are looking for ahead of time, how are they to decide which one is best for them? Depending on your branding, this can be an almost impossible experience – that is unless the category filters (faceted navigation) are well considered and thought out. Consider the following examples:

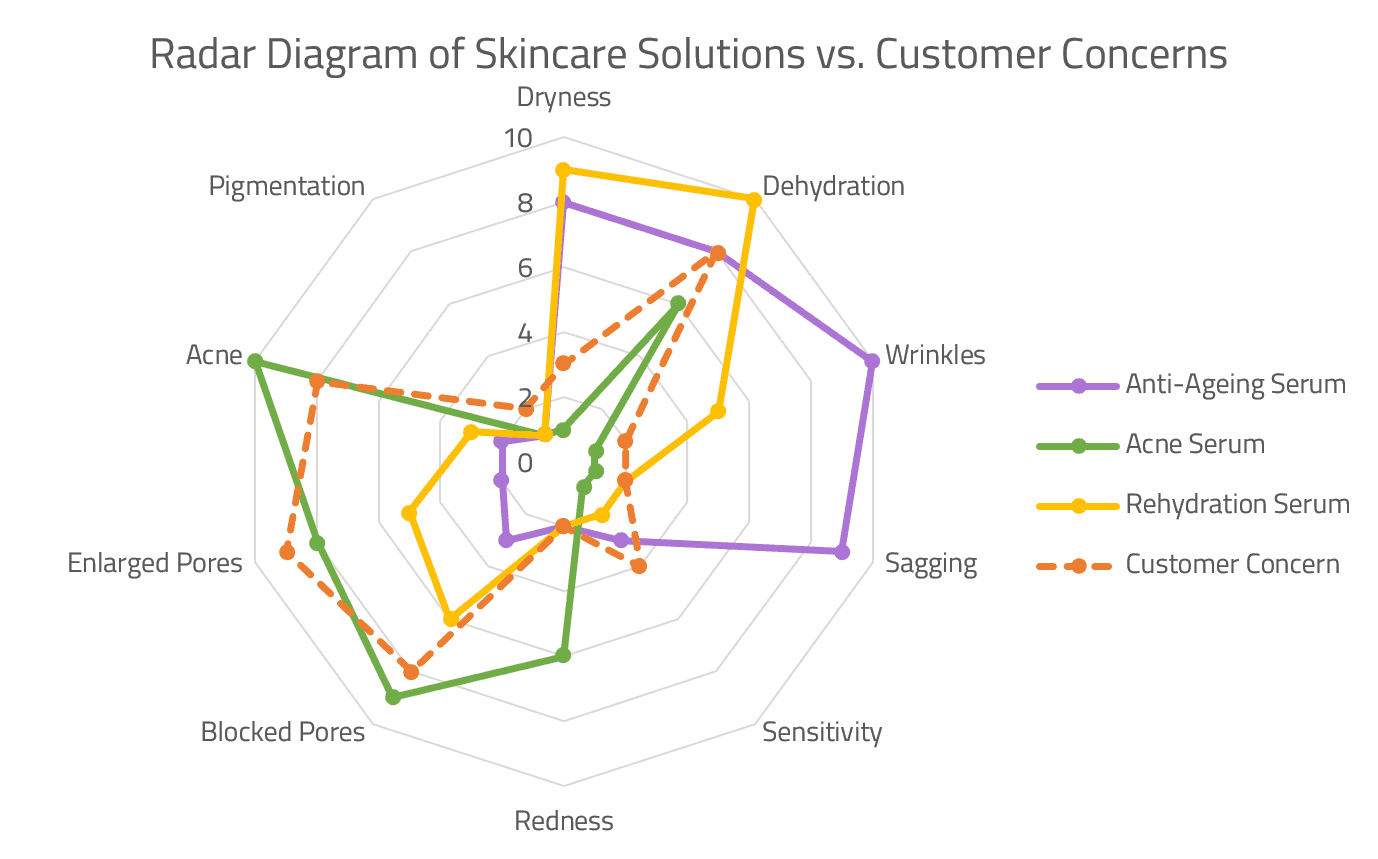

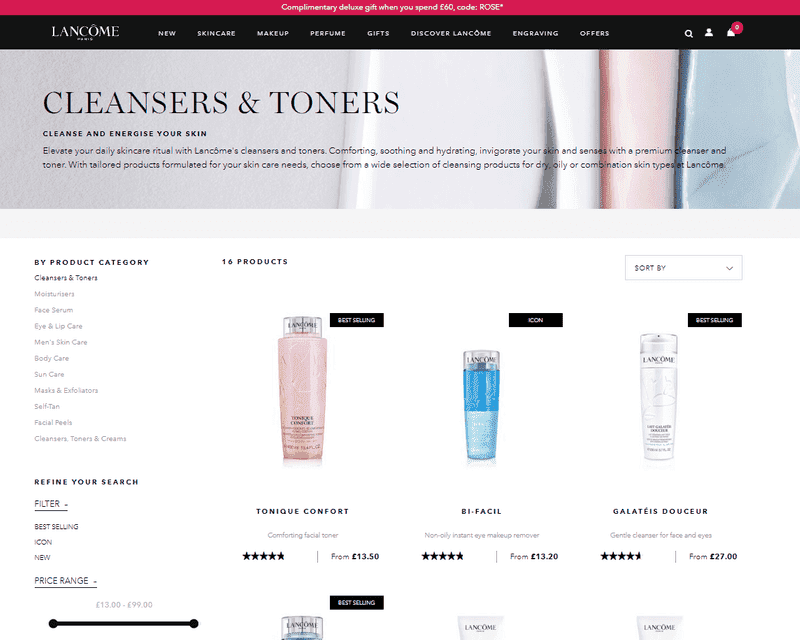

Lancôme Product Categories

Lancôme do use a certain amount of colour coordination with their products, and tend to follow ‘standard’ industry colour coding: green for oiliness and acne, white for sensitivity, purple for antiaging etc. This does make what is a frustrating moisturiser category page with its 33 different products, a little easier to navigate.

However, the implementation that would make these monster category pages easier to navigate, has been left largely unloved rendering it very difficult to make a selection – unless you’re already familiar with the brand’s offering.

The sidebar on the left only includes product category filters, whether the product is best-selling, an icon (surely the same thing) or new, and the price. This is reasonably useless and means the user is shopping based on popularity and price only, which does the brand and products a great disservice. Credit should be given to the subtitle underneath each product which gives a five-word explanation of what it does, although the word length does render these a little vague at times.

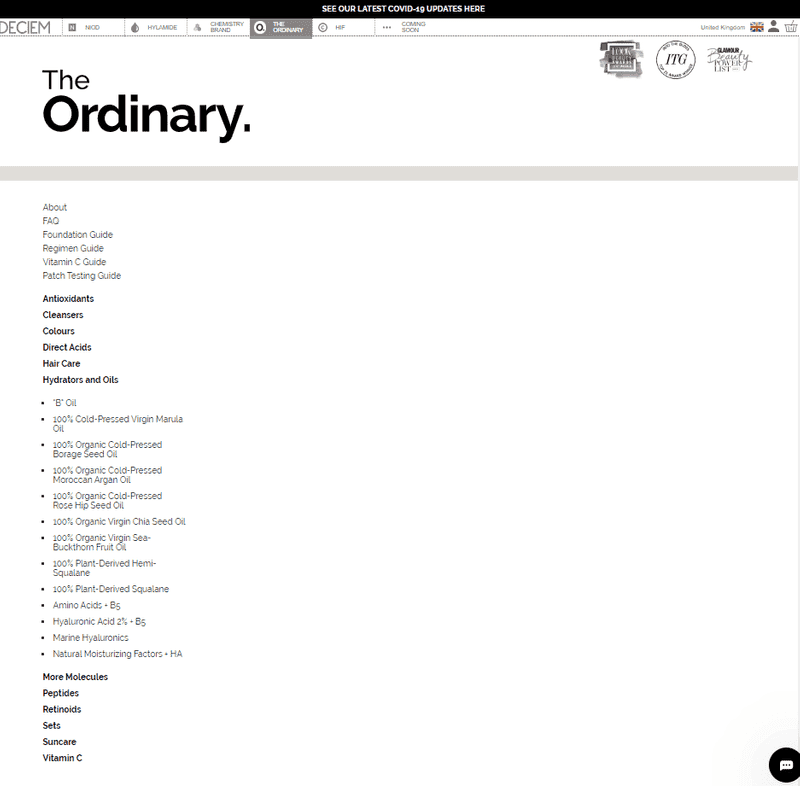

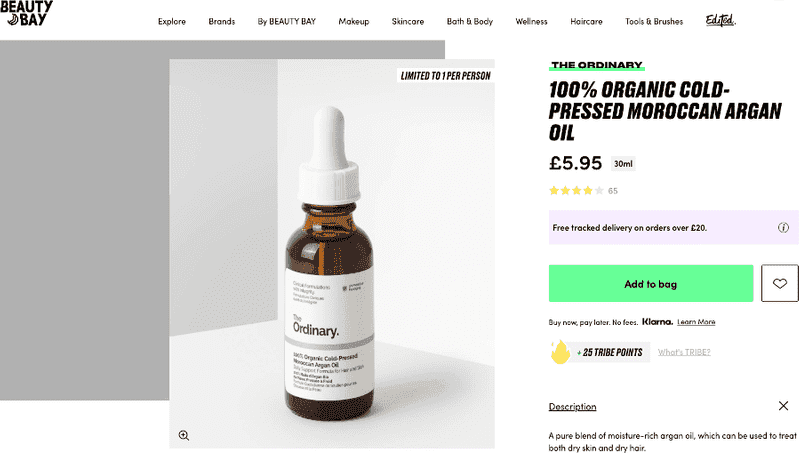

Deciem The Ordinary Product Categories

The Ordinary products are some of the industry’s most loved. Their formulations are adored and well respected, including by the authors of this report. However, their website, is severely lacking; and that is said with love.

The thing that makes The Ordinary so appealing is what also makes it an objective nightmare to sell online. The products all look almost identical and look stunning on your shelf when stacked side-by-side. The only real variations are the slight colour differences of the liquids, or the different coloured glass of a few of the bottles, as well as a couple of squeezy tubes. With that being said, The Ordinary don’t do anything to try and overcome this and help you out, other than relying on the live chat feature. This is their website:

Yes, that is it, it is not broken; there are no category pages. Products are put into dropdown concertinas under their respective product groups. Clicking on a group reveals a list of each product and nothing short of a cosmetic science degree would help you here. There is no real flow that helps you through their offering except for the very bare-bones guides. To gain any insight, you need to click into each product to find out what it does and if it is something relevant to you. How many product clicks they expect from a user before they go somewhere else in frustration, is unclear.

Once you click into each product, there is a lot of great information there, although some could do with more explanation for those less knowledgeable. But getting to that point is infuriating. Funnily enough, our next example does a better job at selling The Ordinary than The Ordinary does.

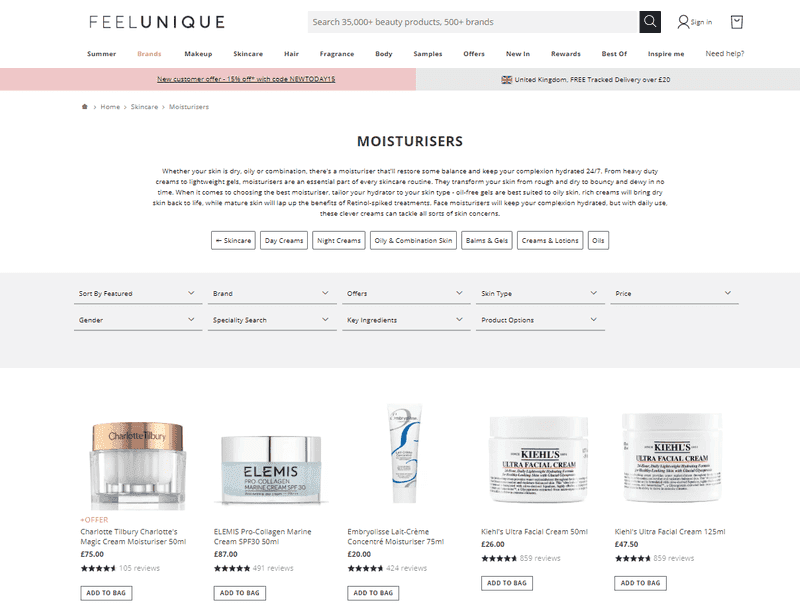

Feel Unique Product Categories

Feel Unique on the other hand get this right. In fact, they get this really right. Their moisturiser category allows multi-filtering i.e. the ability to choose more than one of each facet. Their facets are: is it featured; brand; offers; skin type; price; gender; speciality (alcohol free, vegan etc.); key ingredients and product options (try before you buy, subscription etc).

This means that without the need for a skincare diagnostics tool, users can filter by the things they care about the most with an excellent mix of commercial and skincare-related facet options.

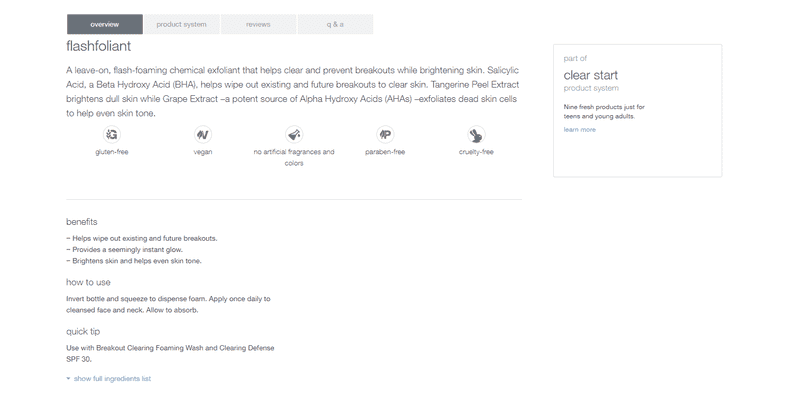

Getting your product pages right, not just from a technical perspective, but from a content and informational perspective could not be more important when it comes to skincare. It is not like buying crockery or a rug – it is more akin to buying medication. However, unlike antiseptic creams and headache tablets, you also have to sell the passion and heritage of the brand as well as your expertise and authority. It is a lot to fit in one page!

Dermalogica have nailed this. A brand driven by the clinics and aestheticians who represent them, their product pages balance lifestyle and passion with skin concern insights and ingredient, providing explanations that are easy to digest. Sections are broken up and anything requiring more detail is linked to. Their product pages are not patronising and or filled with beauty buzz words and superfluous language, yet still fun and not too clinical. The page has all the information you could need, including ingredients, reviews, and a user-driven Q&A section akin to Amazon’s.

However, there’s always room for improvement. Dermalogica feature a prominent banner near the top giving a quote from their brand ambassador. When you are paying for and/or publicising someone, you are hardly going to give a bad quote and even if you did, Dermalogica would not feature it. Therefore, it is totally useless and totally transparent unless you are a supporter of this particular influencer. It can then make the user question the impartiality and trustworthiness of everything that comes after it. Brands can and should use influencer marketing where appropriate, but not on a product page unless we are talking A-List celebrities.

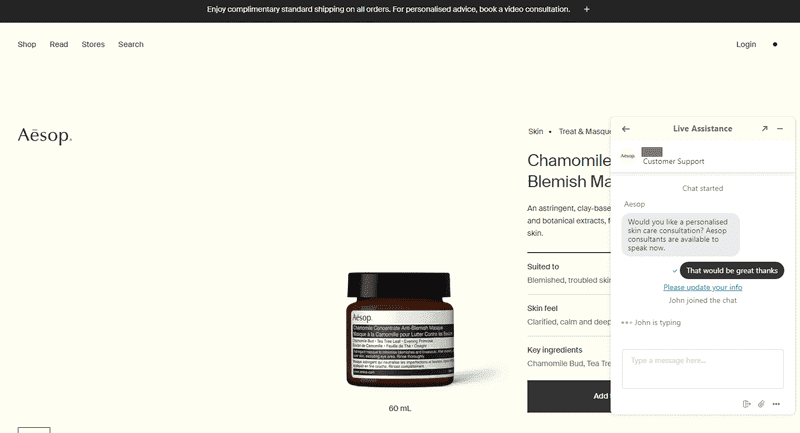

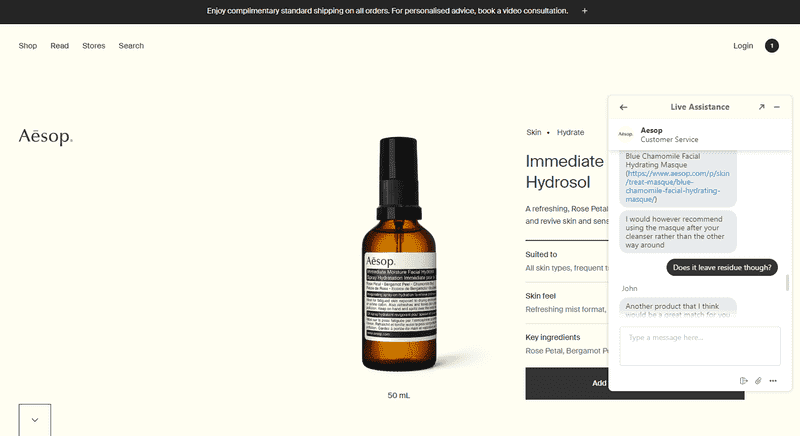

Want to Go Simpler? Chat.

If you are adamant on keeping your product pages simpler and do not want to spend the time creating in-depth content around concerns, applications and treatments, then put resource into live chat. Aesop have a very simple site that’s clean and imagery focused. Their description of concerns is limited at best, however very quickly you will be prompted with a live chat box.

Whilst writing this report, we used the service to find out how well it worked. The representative we spoke to knew skin and the product line – it was an enjoyable experience. Products were recommended but we were not sold to. This is the sort of experience that will keep users coming to your brand rather than a third-party reseller – customer service agents at an online departments store are not going to know about every product of the thousands of lines they sell. But as a brand, you will. Give your customers access to your expertise; online requires the same love and focus an offline store does.

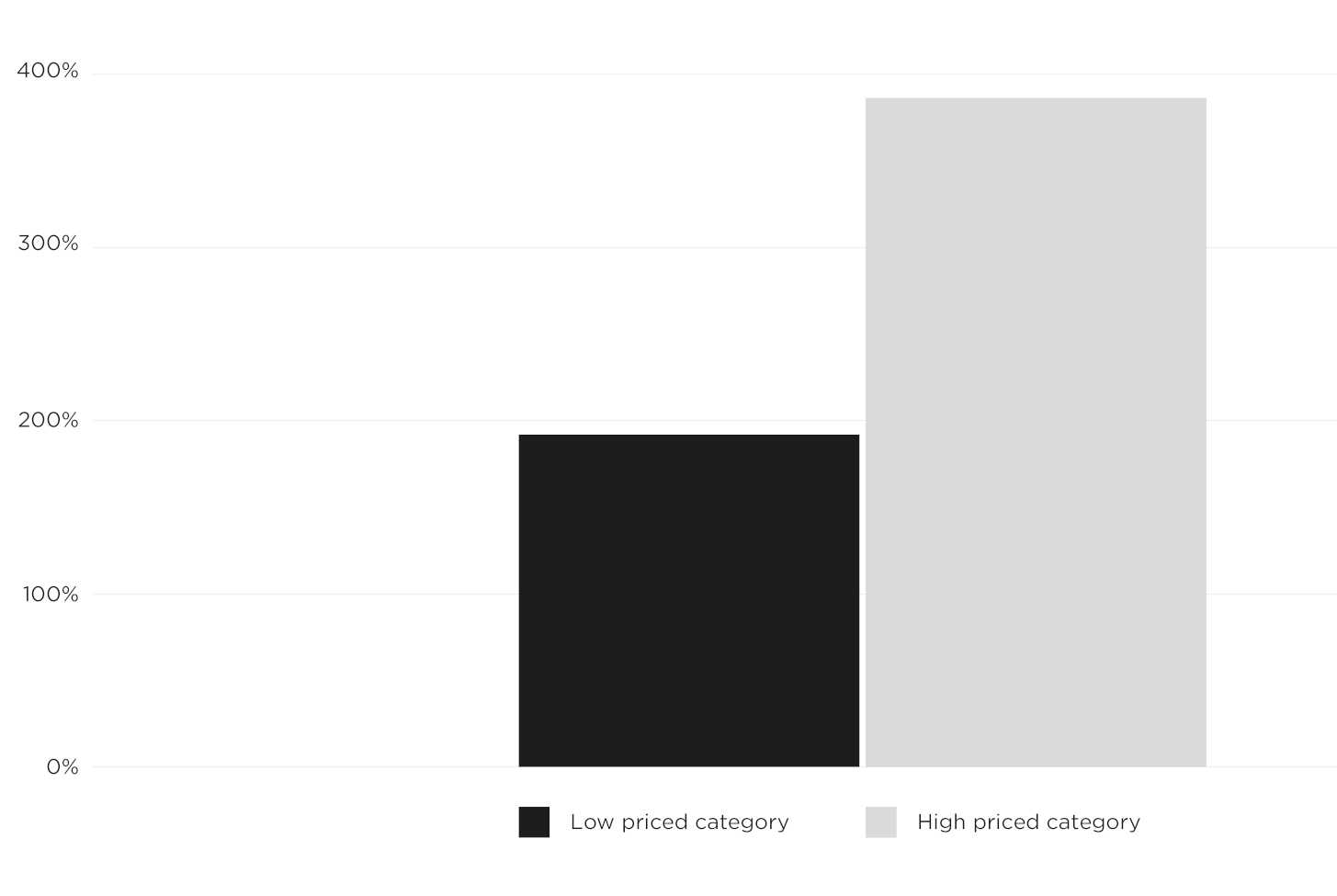

Social proof in a sector that has community running through its culture is something that can have a powerful and positive impact if implemented well and correctly maintained. Displaying reviews can increase conversions by 270% (Tom Collinger, 2017).

Price Effect

Reviews should become integral to your online experience, both in how you drive customers and your business. As the cost of an item scales, positive and visible reviews can have an exponential influence on purchase intent.

Based on data from an online gift retailer, when reviews were displayed for a lower-priced product, the conversion rate increased by 190% (Tom Collinger, 2017). However, for a higher-priced product, the conversion rate increased by 380% (Tom Collinger, 2017). This is because reviews help remove perceived risk, which is crucial as perceived risk increases as the item price increases.

Negative reviews

Negative ratings or reviews can hinder the purchase performance of a product, but that is not always the case. However, having five stars across every product is not the ideal scenario and can look fake. An honest mix of ratings will have a more positive impact and not make the reviews appear to be “too good to be true”. For example, a customer is much more likely to purchase a product that has a rating of 4.7 than 5 stars (Tom Collinger, 2017). You may also believe that negative reviews are the worst thing that can be present alongside a product but negative reviews establish credibility. Research by Revoo saw that consumers spend four times as long on a site when they interact with negative reviews, with a 67% increase in conversions (Sean Callahan, 2017).

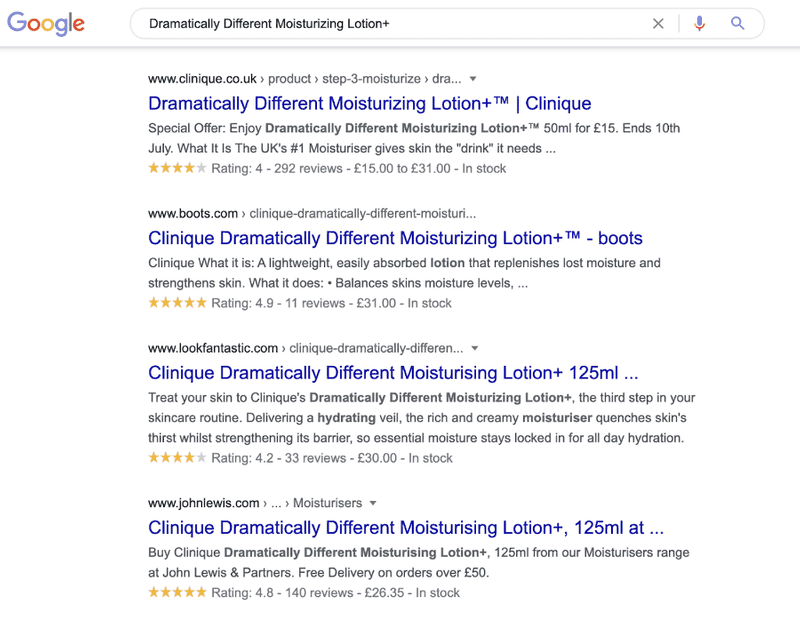

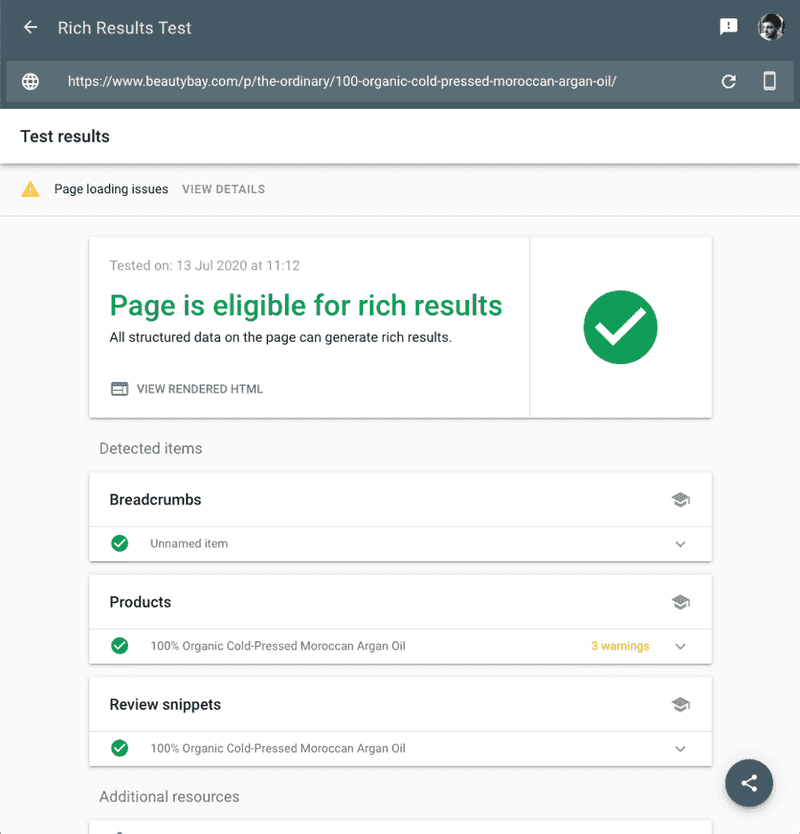

Review exposure in organic search

Considering how to best utilise your hard-earned reviews is particularly important. You can display your review ratings within Google’s search results by utilising schema markup in your website (Google LLC, 2020). Schema markup also allows you to display the price and stock status of an item, giving you the opportunity to influence a searcher to visit your site over a competitor.

The image above is a Google search for “Dramatically Different Moisturizing Lotion+” and shows the use of schema markup being used to generate the star ratings, item price and stock status information right in the Google search results page. Not taking advantage of this could be the difference between a customer choosing a competitor’s website above yours. Always consider where your customers find your site.

Displaying Reviews Onsite

When it comes to displaying your reviews onsite, there are lots of 3rd party suppliers that you can choose from, including Trustpilot, Reviews.io, Bazaarvoice to name a few. But what is important when considering a reviews technology partner?

To maximise the impact of reviews on your site, you need to make sure that their coding implementation embraces features such as schema markup that would allow you to appear in Google’s rich results, as well as onsite visibility that works across all devices. You need to consider where the reviews are displayed, too. Below is an example of a Bazaarvoice implementation on Beautybay.com, who have their reviews in line with product listings.

The image shows a category page where review stars and counts are clearly displayed and form part of the aesthetic of the page. It is important to be more sensitive if you are a brand versus a reseller, as it’s easier for a reseller to drop a product or a skincare line versus the brand who created it.

This above shows a product page where reviews are again a clear feature. The reviews themselves occupy the bottom of the product page where the first five reviews are displayed – an optimal amount to display by default.

When running the Beautybay.com product page through Google’s rich results testing tool, the page returns that it is eligible for rich results and includes breadcrumbs, products and review snippets markup. This means that the page will display additional information within Google’s search results pages, a feature that is not only the correct way of implementing reviews, but something that can provide a real advantage.

A skincare brand online should be building a customer-centric culture and obsessing over how your customers are using and interacting with your site. In the same way a merchandiser would test arranging in-store displays and walkway directions, this thought process should be applied online. The difference is you have a plethora of data available and the capability to collect really insightful information from your customers.

Your website should be considered as a living thing; a programme of continuous improvement should work towards maintaining the best user experience and improving the conversion rate of your website. The discipline of conversion rate optimisation is vast but there are key principles that can be applied which will provide significant value.

Quantitative tools

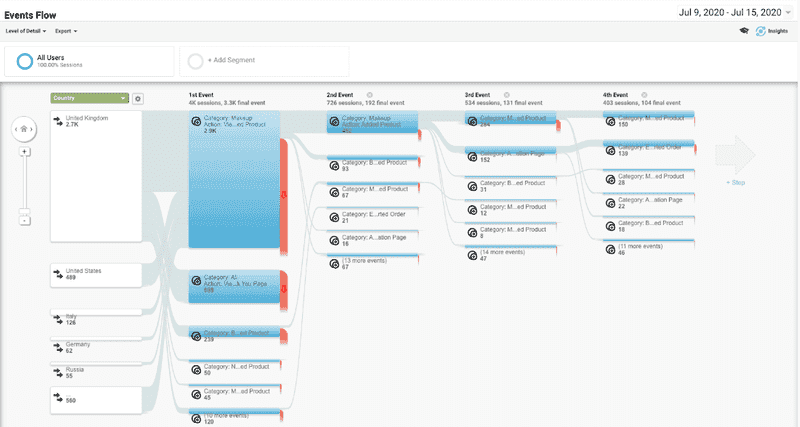

Quantitative tools such as Google Analytics, the industry standard for website tracking, offers huge amounts of valuable data that can be analysed to ascertain things like where your traffic is coming from, what people are clicking on and what pages they’re navigating between whilst browsing your skincare products.

Taking a skincare tree as an example, by using Google Analytics event tracking capability you would be able to create bucketed audiences, building a picture of who is using it and how they are moving through the process.

These events would be built around the choices made within the skincare tree consultation process and record actions, capturing specific interaction data for customers using the tool. Over time, you will be able to build a picture of your different audience types, identify any blockages within the process and use that data to improve the process. These audiences could also assist in paid and social media ad targeting, providing additional direction when it comes to paid media activity.

Google Analytics also has visualisation tools that allow you to visualise the user flow based on the events you have set up.

This visualisation allows you to quickly validate which sections of your skincare tree users are engaging with and how they progress through the process. This analysis will also determine potential blockages in the flow or highlight demand for a specific audience type and product set.

Utilising a tool such as Hotjar will give you an added layer of data collection capability with increased functionality and customisation options. Features such as heat mapping (tracking mouse and click interaction and turning it into a visualisation) will provide valuable user experience insights. Hotjar also provide enhanced funnel tools which allow you to measure and visualise where users might be dropping off the purchase journey.

Immediately, if you were to use the tools mentioned above, you would have the foundation to begin making data driven improvements focused around the skincare buying user experience which ultimately aim at increasing your conversion rate.

Qualitative tools

Qualitative tools focus more around non-numerical, behavioural and feedback driven data. This kind of information gathering can include session recording and usability testing sessions, but one of the most valuable qualitative analysis is user feedback.

To collect truly valuable data from your users using feedback forms, you need to compile questions that will provide actionable insights. This is not fool proof, as you will have users who provide answers that you could not possibly anticipate, but if you persist, this data will provide invaluable real-world insights.

Website onsite surveys

Onsite surveys are a non-invasive way to gather feedback without interrupting user experience, in the way that something like a pop-up form would do.

Using open ended questions is a good place to start when gathering feedback and will likely uncover things that you may not have even considered to be wrong with your website.

But why does gathering feedback matter? It matters because if you focus on building a customer-centric culture, implementing changes based on how your customers use your website and what they think of your brand, you’ll not only be working towards improving your conversion rates but you will also be creating happier customers – and happier customers are more likely to purchase from you.

Buyers possess a finite amount of time to read about the brands and products they’re interested in, their benefits, compatibility and pricing. Busy lives mean that information must be processed on the go resulting in fractured recall. During a quick browse on the morning commute or during a lunch break, there’s little time and opportunity to fully immerse the buyer and encapsulate the complete message.

Reconnecting with buyers following an initial engagement is an essential practice in helping to build trust and communicate brand. It is also another opportunity to keep dialog open and to maintain interest until the buyer feels comfortable making a purchase. This can be achieved through forms of display and social media marketing. The most effective technique is ‘user retargeting’ which tracks a user’s past engagements helping to predict buyer intent. It is also a great way to tailor messaging to buyers’ specific needs.

Example

Take an engaged user. You’ve recorded their engagements with products but they’ve demonstrated no clear intent to purchase. There are typically four main causes of this behaviour:

- They have not found the product they are looking for

- They do not trust the brand

- Competition offers something similar

- Pricing

Each of the above can be addressed via retargeting activity. A couple of examples include:

- Suggest similar products they have not seen yet that are well matched to their browsing history

- Increasing the frequency of your message via social media & display

- Amplify your social proof & relationship with customers

- Promotional content to raise value

Though retargeting, it is also recommended to remind existing customers to place refill orders at the most common refill intervals for a given product. Customers can be reached on an individual basis via display and social media to encourage repeat subscription. It is also a great opportunity to promote new ranges and tease pre-launch products.

Going Further

Skincare has a unique challenge. As an invisible layer, skincare cannot take as much advantage of some of the more innovative systems that make-up brands are utilising today, such as virtual try-ons.

The future of skincare and any retail is a hybrid one between online and offline. Offline retail should be focused on brand experience, new product discovery and customer service. Additionally, there should be a direct link between the offline and the online. For example, to learn more about any product instore, retailers could display a code to scan on your phone to provide more information, see video or animation for best use, or even purchase to take advantage of trusted payment systems.

Online is more of a shopping and informational experience and should encourage offline shopping based on geolocation, pickup/returns, physical try-on and product education with brand ambassadors. We are perfectly poised to stop looking at each entity as unique and start looking at them as one.

Skincare does have a significant opportunity to utilise experience design by leveraging the power of emotion and wellbeing. Hydration, cleansing, smoothing and relaxation are all not only all very tactile realities of great skincare products, but are emotional benefits of using these products. Creating representative media, interactives, and even gaming, are all opportunities to bring users into the benefits of skin care. In addition, there are touch-up and glow filters that can emulate certain qualities of skincare virtually, but it may be less of a sell than trying on a lipstick shade from your phone.

Expensive retail is a challenge, but if you are looking at it as a sales-per-square-foot play, you are already losing. Unless you are Apple, NIKE, Tiffany’s or Best Buy, chances are that it will be hard to earn back the costs of running your flagship store. Instead, take a page from the banking industry.

Measuring Consumer Engagement in the Brain to Online Interactive Shopping Environments: ASOS.com, the UK’s top fashion online pure player, is used as a preliminary research study. The results demonstrate that engagement is significantly different in social media, video and browsing tasks, and browsing for jackets online elicits more engagement (Dulabh et al., 2018).

In a 2020 publication, IBM released a patent for a machine learning product recommendation engine. This engine identifies characteristic patterns of gift recipient based on the recipient’s purchase history, gift-giving history, demographics, social-media postings, relationship with the purchaser, or other contextual information that may be retrieved or inferred through methods such as data-mining, artificial intelligence, online analytics, or pattern-matching. The engine then uses these patterns to select and recommend to the purchaser one or more alternate gifts that the recipient is likely to prefer over the purchaser’s original choice. (Anders et al., 2020).

The Authors

Bibliography

- Anders, K., Fox, J. R., Deluca, L. S. and Greenberger, J. A. (2020) ‘Ecommerce product-recommendation engine with recipient-based gift selection’, [Online].

Available at https://patents.google.com/patent/US20200020015A1/en (Accessed 4 June 2020). - Beaut.ie (2012) The Counter Culture:Clinique Shake Things Up With Service As You Like It & iPad Consultations [Online].

Available at https://www.beaut.ie/beauty/the-counter-culture-clinique-shake-things-up-with-service-as-you- like-ipad-consultations-54305 (Accessed 10 June 2020). - Bernstein, S. (2009) Sensitive Skin: Is It a Myth? [Online]

Available at https://www.webmd.com/skin-problems-and-treatments/features/sensitive-skin-myth (Accessed 3 June 2020). - Byrnes, T. and Mujtaba, B. G. (2011) ‘The Value Of B2B Face-To-Face Sales Interaction In The United States, Canada And Latin America’, International Business & Economics Research Journal (IBER), vol. 7 [Online].

DOI: 10.19030/iber.v7i3.3236. - Cai, Y., Shen, K. N. and Guo, Z. (2012) ‘Adding bricks to clicks:

when do offline channel attributes influence consumers’ intentions to shop online?’,. - Cai, Y., Shen, K. N. and Guo, Z. (2012) ‘

Adding bricks to clicks: when do offline channel attributes influence consumers’ intentions to shop online?’,. - Celletti, E. N. (2017) Derms Share the Most Common Skin Misdiagnoses [Online].

Available at https://www.allure.com/story/misdiagnosed-skin-conditions (Accessed 18 June 2020). - Charlton, G. (2019) ‘Why Do People Abandon Shopping Carts?’, SaleCycle [Online].

Available at https://www.salecycle.com/blog/strategies/infographic-people-abandon-shopping-carts/ (Accessed 18 August 2020). - Dulabh, M., Vazquez, D., Ryding, D. and Casson, A. (2018) ‘Measuring Consumer Engagement in the Brain to Online Interactive Shopping Environments’, in Jung, T. and tom Dieck, M. C. (eds),

Augmented Reality and Virtual Reality: Empowering Human, Place and Business, Progress in IS, Cham, Springer International Publishing, pp. 145–165 [Online]. DOI: 10.1007/978-3-319-64027-3_11 (Accessed 3 June 2020). - Estée Lauder Companies (n.d.) On Counter Technology [Online].

Available at https://oct.estee-lauder.co.uk/oct/ (Accessed 10 June 2020). - Hautala, M. (2019) ‘Distrust towards social media influencers : causes and contribution of user’s age, gender and social media use’, [Online].

Available at https://jyx.jyu.fi/handle/123456789/66916 (Accessed 23 June 2020). - Jennifer Faull (2015) Tesco kicks off 12-month focus on beauty category with online blogger consultations [Online].

Available at https://www.thedrum.com/news/2015/02/24/tesco-kicks-12-month-focus-beauty-category-online- blogger-consultations (Accessed 4 June 2020). - Kwon, W.-S. and Lennon, S. J. (2009) ‘What induces online loyalty? Online versus offline brand images’, [Online].

DOI: 10.1016/j.jbusres.2008.06.015. - Market Track (2017) New Market Track Study Reveals Retail Sector Now in an Age of “Channel-Less Shoppers” [Online].

Available at https://www.businesswire.com/news/home/20170330005423/en/New-Market-Track-Study- Reveals-Retail-Sector (Accessed 19 June 2020). - ONS (2018) Comparing “bricks and mortar” store sales with online retail sales - Office for National Statistics [Online].

Available at https://www.ons.gov.uk/businessindustryandtrade/retailindustry/articles/ comparingbricksandmortarstoresalestoonlineretailsales/august2018 (Accessed 3 June 2020). - ONS (2020) Internet sales as a percentage of total retail sales (ratio) (%) - Office for National Statistics [Online].

Available at https://www.ons.gov.uk/businessindustryandtrade/retailindustry/timeseries/j4mc/drsi (Accessed 3 June 2020). - Petro, G. (2019) Consumers Are Spending More Per Visit In-Store than Online. What Does This Mean for Retailers? [Online].

Available at https://www.forbes.com/sites/gregpetro/2019/03/29/consumers-are-spending-more-per-visit-in- store-than-online-what-does-this-man-for-retailers/ (Accessed 17 June 2020). - Wu, P. C. S., Yeh, G. Y.-Y. and Hsiao, C.-R. (2011) ‘The effect of store image and service quality on brand image and purchase intention for private label brands’, Australasian Marketing Journal (AMJ), vol. 19, no. 1, pp. 30–39 [Online].

DOI: 10.1016/j.ausmj.2010.11.001.